Who needs an RRSP?

Most Canadians aren’t big savers to begin with, so when you start throwing financial acronyms at them like RRSP, TFSA, ETF, HESG (that last one is made up), it’s no wonder they get confused. Even those with good intentions might partake of the investment vehicles these acronyms represent but lack an understanding of their potential leads to them being under-utilized.

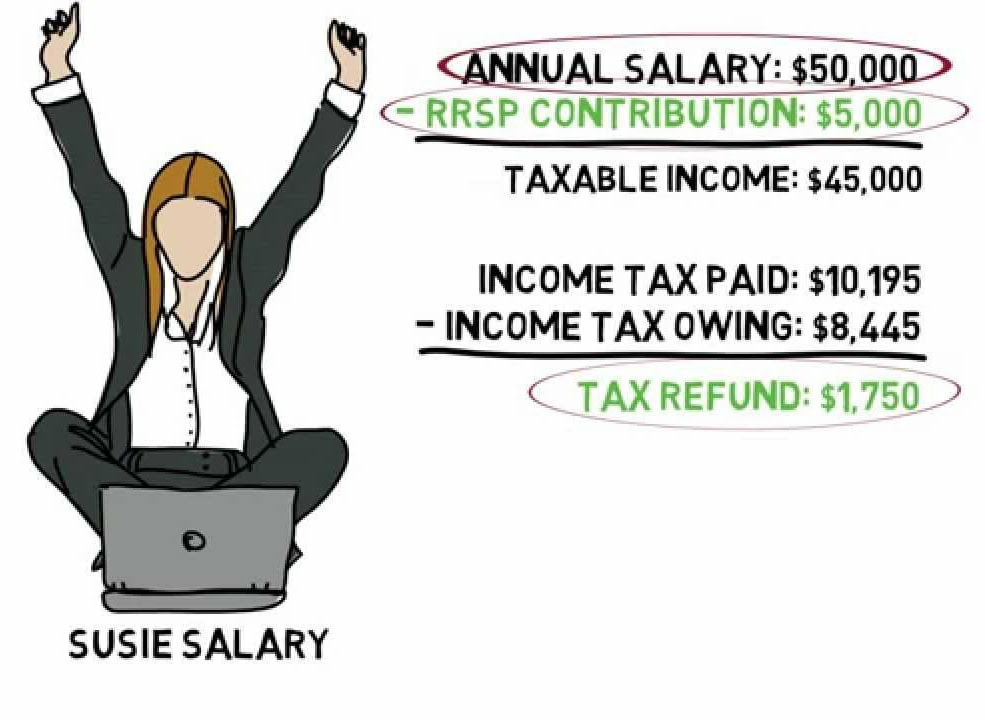

Individual RRSPsA Registered Retirement Savings Plan (RRSP) is a type of Canadian account for holding savings and investment assets. RRSPs have various tax advantages compared to investing outside of tax-preferred accounts.

An individual RRSP is an account that is registered in your name. The investments held in the RRSP and the tax advantages associated with them belong to you.

|

Spousal RRSPs

|

A spousal RRSP is registered in the name of your spouse or common-law partner. They own the investments in the RRSP, but you contribute to it. You get the tax deduction for any contributions you make to a spousal RRSP. Any contributions you make reduce your own RRSP deduction limit for the year. They won’t affect how much your spouse can contribute to their own RRSP.

A spousal RRSP is a way for you and your spouse to split your income more evenly in retirement. That means the combined income tax you pay as a couple may be lower than what you would pay if all your savings were in a single RRSP. You may want to do this if you earn more money than your spouse and you’re likely to be in a higher tax bracket when you both retire. Or if you have a pension plan and your spouse doesn’t. |

To qualify for a spousal RRSP, you must:

- have lived together as a couple for at least 12 months,

- have a child together by birth or adoption, or

- share custody and support of your partner’s children from a previous relationship.

If your spouse takes out money you have contributed:

- within 3 years of the contribution date – you’ll have to pay tax on the withdrawal amount

- 3 years after the contribution date – your spouse will pay tax on the withdrawal amount.

If your relationship ends:

- if you are married – spouses generally have to divide assets equally

- if you are living common-law – consider drafting a joint agreement to cover this situation as assets may not necessarily have to be divided equally.

Group RRSPs

Some employers offer group RRSPs as a benefit to help employees save for retirement. You open an individual RRSP, but you contribute to it through your employer. The RRSPs of all of the employees are held at the same financial institution. Here’s how it works:

- Your plan contributions are usually automatically deducted from your pay. Your employer may match or add to your contributions.

- Your employer usually pays the costs of opening and managing the plan. You pay any investment costs.

- The range of investment options is usually limited, depending on where the group RRSP is held.

- The rules for when and how much money you can take out of the plan vary depending on your employer.

For more information and resources, please email us at www.mcdougallinsurance.com or use our contact form.

You can also visit the Canada Revenue Agency's RRSP section.

You can also visit the Canada Revenue Agency's RRSP section.